Wiki article

Compare versions Edit![]()

by Hubertus Hofkirchner -- Vienna, 12 May 2015

“Everyone, including all the prediction markets/betting exchanges, got the UK 2015 vote prediction wrong.”

Prediction markets are an often misunderstood mechanism and unsuspecting readers will find many definitions of varying quality more likely to confuse than to enlighten. So, when even leading market researchers inadvertently lump prediction markets together with betting exchanges, it is high time for a clarification: Betting exchanges are not prediction markets.

The common denominator: mechanism

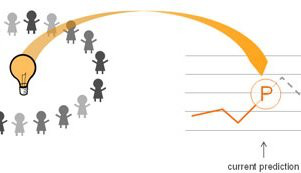

Before going into the differences, let us start with the similarities. Of course, betting exchanges and their big brothers, the financial exchanges, are market places, just like prediction markets. They all employ some form of an auction mechanism for price discovery. Prof. Charles Plott’s famous experiments showed the market mechanism's astonishing capacity to gather information from people’s distributed beliefs, hunches, and opinions and to aggregate this collective intelligence like a virtual statistician.

This is where the similarities stop. Prof. Plott added that these prices are “for all to see” which is not necessarily so as we will see momentarily. The biggest differences between the three market types is their primary purpose and their informational content.

The three market types

Financial markets discover the monetary prices of financial assets, in essence the present value of various forms and flavours of future cash flows. These are very complex and depend on both fundamental factors regarding the financial asset but also on central bank and credit policy regarding the monetary part. Nobel Laureate Vernon Smith showed how ill-advised government credit policy will undermine the market mechanism, and can produce catastrophic stock bubbles.

Betting markets redistribute money depending on future events. They are primarily not for economic but for entertainment purposes of punters who take the financial risk for a purely speculative gain. While betting price discovery does reflect the aggregated opinion about the likelihood of future events to some degree, there maybe important incentives for participants not to reveal their true belief and to profit from wrong prices, as evidenced by betting scandals.

Prediction markets are designed for the primary purpose of collecting and aggregating the best possible forward looking information. Prices of prediction markets can be, and normally will be, confidential for paying clients’ eyes only. Prediction markets incentivise and reward respondents proportionately to the timeliness and quality of their informational contribution in relation to a potential objective outcome, but they do not bring any financial downside for participants. Trading is with virtual money for virtual instruments.

One more thing

This is not where it ends because there is no such thing as “the” prediction markets. Different prediction market platforms may and do employ very different market (auction) mechanisms, different market rules, samples, processes, functionality, and market microstructures - which in turn greatly impacts the quality of their quantitative and qualitative results.

All of these differences should be kept in mind for the next time when you hear someone refer to “the prediction markets”.